The U.S. House of Representatives is currently reviewing a major budget reconciliation proposal that would make lasting changes to Medicare payment reform. Section 44304 of the bill—strongly endorsed by the American Medical Association (AMA)—offers the first permanent update tied to inflation since the passage of MACRA in 2015. Here’s what MOCMS members need to know and why it matters for physicians nationwide.

Key Changes in Medicare Payment Reform (Section 44304)

Section 44304 replaces the current Medicare physician payment update structure with an inflation-tied formula:

- 2026: All physicians will receive a 2.25% update based on 75% of the Medicare Economic Index (MEI).

- 2027 and beyond: Annual updates will equal 10% of MEI—currently estimated to be ~0.25%.

This replaces the existing structure of:

- 0.25% annual updates for most physicians

- 0.75% annual updates for APM participants

Unlike past updates, this change is permanent and avoids the recurring “cliff” when temporary payment fixes expire.

Download the full legislative comparison (PDF)

Projected Financial Impact Over 10 Years

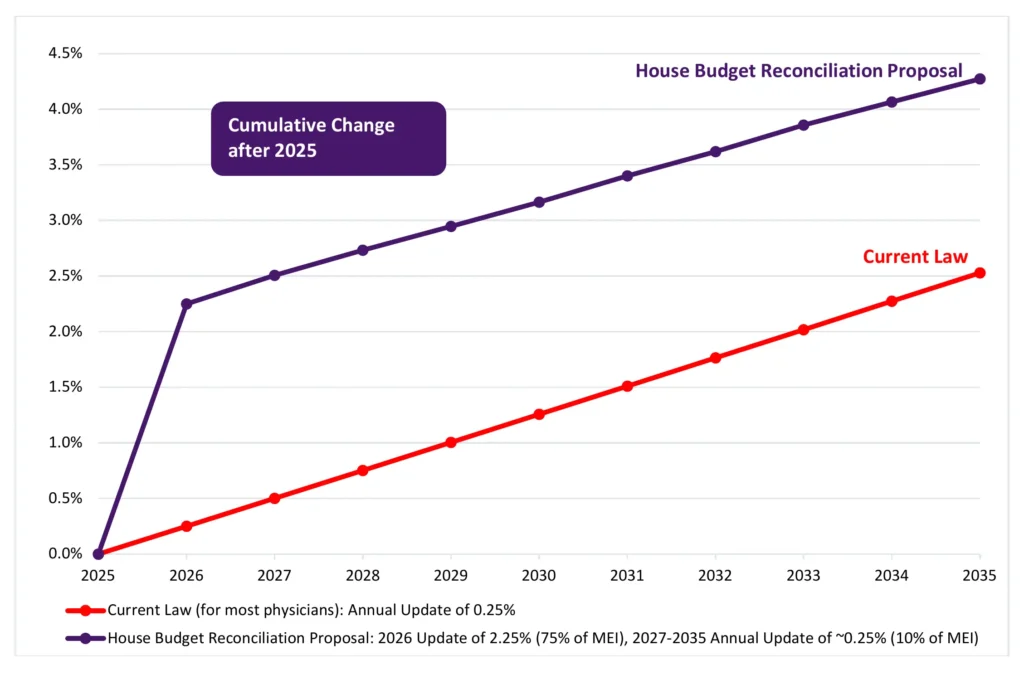

According to CMS projections, the House proposal will:

- Increase Medicare spending by $8.9 billion over 10 years

- Raise the cumulative physician payment update from +2.5% (under current law) to +4.3%

AMA Advocates for Medicare Payment Reform

In a May 20 letter to House leadership, the AMA urged passage of Section 44304, citing decades of underpayment, unsustainable practice conditions, and declining physician ownership rates.

“This is the first permanent Medicare physician payment update since MACRA… and it’s a foundational step toward meaningful reform.” — AMA

Read the full AMA letter (PDF)

Myth vs. Fact: Section 44304

The AMA provides clarification on several misconceptions surrounding the legislation:

- Myth: There’s a payment cliff after 2026.

Fact: The 2.25% increase becomes part of the baseline and does not expire. - Myth: APM participants lose out in the long run.

Fact: They receive higher cumulative increases through 2028 compared to current law. - Myth: The bill triggers budget neutrality.

Fact: It does not. Budget neutrality is triggered by CMS changes, not Congress.

View full Myth vs. Fact sheet (PDF)

Why Medicare Payment Reform Matters to Physicians

The House reconciliation proposal offers more than just a temporary fix. By linking payments to inflation and eliminating year-over-year uncertainty, it helps stabilize physician practices and supports long-term sustainability.

MOCMS encourages members to review the proposal and share their feedback with elected officials.